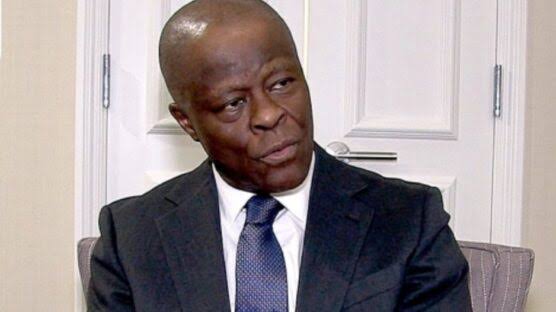

The Federal Government has announced plans to issue bonds worth N758 billion to settle accumulated pension liabilities under the old Defined Benefit Scheme, which predates the 2004 Contributory Pension Scheme. This decision follows years of growing pension debts due to wage increases, making it difficult to pay out the accrued liabilities. Finance Minister Wale Edun revealed this plan after the Federal Executive Council (FEC) meeting, emphasizing that the bond issuance will provide much-needed relief to pensioners waiting for their dues. This step aims to clear pension debts and ensure timely payments to those entitled to funds under the outdated system.

Additionally, the FEC approved a €30 million long-term concessional financing arrangement to address the national shortage of student accommodations. This funding, sourced from the French Development Agency and executed by Family Homes Fund Limited, aims to provide clean-energy-based housing solutions for students in tertiary institutions across Nigeria. In the same meeting, Edun highlighted the approval of the National Single Window Project, a key initiative to enhance Nigeria’s export processes and global competitiveness, particularly under the African Continental Free Trade Agreement (AfCFTA). This project is expected to boost both government revenue and the country’s economic productivity.

Furthermore, the council ratified the African Medicines Agency Treaty to enhance Nigeria’s regulatory capacity for medical products, ensuring safer, more effective medicines for the country and wider Africa. In alignment with this, a N12 billion investment was approved for major diagnostic equipment, including MRI and CT scanners, to improve healthcare facilities nationwide. These initiatives signify the government’s ongoing efforts to bolster Nigeria’s infrastructure in sectors like healthcare, education, and trade, while improving fiscal management and international competitiveness.