The Federal Government has announced new tax reliefs aimed at boosting investments in Nigeria’s deep offshore oil and gas production. These incentives include the removal of value-added tax (VAT) on key energy products and infrastructure such as diesel, feed gas, Liquefied Petroleum Gas (LPG), Compressed Natural Gas (CNG), electric vehicles, and clean cooking equipment.

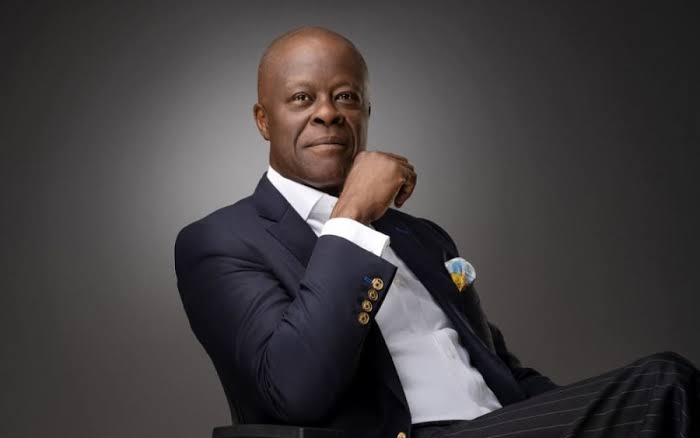

Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, outlined the measures in a statement on Wednesday. The policy is designed to attract global investments to Nigeria’s oil and gas sector while promoting energy security and the transition to cleaner energy sources.

The tax reliefs come amid new divestment plans by ExxonMobil and Seplat, which are expected to receive approval from President Bola Tinubu soon. These fiscal incentives reflect the administration’s commitment to revitalizing the nation’s energy sector and positioning Nigeria as a leader in the global oil and gas market