IN THE DEMOCRATIC REPUBLIC OF THE CONGO; MINING REVENUES RISE BY 36%, OIL AND GAS BY 100%.

D.R. CONGO saw 2017 mining revenues rise by 36% to $822million and oil and gas by 100% – to $203million the only bright spots in a sea of refuges, fleeing armed conflict and political strife.

CEO

IVAN

GLASENBERG

Source: Glencore

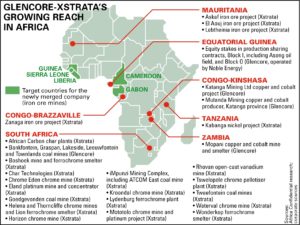

Most of Glencore’s operations are in the Congo. its imprints are everywhere, -from the new buildings and expanded runway at the tiny Kolwezi airport in the southernmost province to the new bridge crossing the Lualaba River, leading to Zambia’s Mutanda copper mines.

Glencore is reported to have invested 5.5billion dollars in the DRC, including on infrastructure, like water and electricity that it needs for its mines – which have also benefitted ordinary Congolese.

The fact is the copper belt extends into neighboring Zambia, where at the Mopani copper mines, Glencore has spent about 1.1billion dollars to sink three shafts, two of them more than a mile deep,- boosting copper production to more than 220,000 metric tons and cobalt to 25,000 tons a year; and employing 5000 workers. Other social responsibility projects include local schools and hospitals.

over 100,000

As regards the Congo, you would have expected that all the mining wealth should lead to prosperity. But the Congo suffers from what is called the “Resource Curse” – just as you have the “Oil Curse”. The immense mineral resources in the DRC, like tin, cobalt, copper, diamonds, gold and others still more in reserve, have led not to rapid economic development but to rampant corruption, political conflicts and insanity. Congo ranks 176 out of 188 countries on the UN’s development ranking, with life expectancy of only 57years. Average income of 446 dollars is still low, although it compares favorably to 1 dollar a day in Nigeria.

Where next is the expansion push? Is it Zimbabwe ?

Glencore is not saying. But the fact is that President Mwangagwa is wooing all major mining companies, boasting that the question is:

Not what Zimbabwe has, but what it doesn’t have?

True, Glencore has prospered because of the insatiable demand for commodities in China, which consumes an astonishing 50% of the world’s aluminum, copper, nikel and zinc. But it required Glencore’s aggressive mining and sales push to optimize the benefits.