The deadline of February 10 for the phasing out of old currency notes that was announced on Sunday by the Central Bank of Nigeria has been rejected by the House of Representatives.

On Sunday, the House of Representatives Ad hoc Committee on the New Naira Redesign and Naira Swap Policy said that the new date was just a political ploy to trick more Nigerians and make it harder for them to live economically and socially.

The development occurred at a time when several bank customers were left stranded due to a lack of access to the new notes, igniting outrage across the nation. Due to the long lines at ATM galleries all over the country, retailers and traders have been rejecting the old notes.

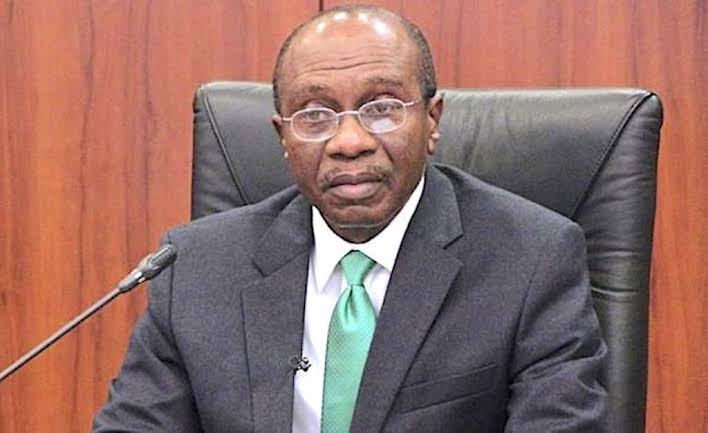

However, the CBN Governor, Godwin Emefiele, stated that the President, Major General Muhammadu Buhari (retd.), announced on Sunday the new deadline for the phasing out of the old N1,000, N500, and N200 notes. following his most recent meeting with him, granted permission for the deadline to be extended to February 10.

He also extended the period of time for Nigerians to deposit their old naira notes until February 10, when the currency ceases to be legal tender.

The CBN had previously set January 31 as the deadline for exchanging old N1,000, N500, and N200 notes.

Despite receiving severe criticism and significant pressure from politicians, banks, customers, and key stakeholders, the apex bank had refused to shift grounds prior to extending the deadline.

The Speaker of the House of Representatives, Femi Gbajabiamila, declared on Tuesday that he was prepared to issue a warrant of arrest against the CBN governor if he failed to appear before its committee last Thursday. The CBN governor had also failed to appear before the House four times.

According to Gbajabiamila, lawmakers would meet again on Tuesday (tomorrow) to take action against Emefiele and other bank chiefs who ignored the house’s request.

However, the CBN governor emphasized in his statement that the currency redesign program was necessary to prevent banditry and ransom-taking and to enable more effective monetary policy decisions.

According to Emefiele, the CBN has not redesigned the naira in 19 years, when it should have done so within five to eight years.

Emefiele listed the advantages and disadvantages of the new design, stating, “Our aim is primarily to make our Monetary Policy Decisions more effective and as you can see; Inflation has begun to fall, and exchange rates have remained relatively stable.

“Secondly, through this program, we aim to support the efforts of our Security agencies in Nigeria to combat banditry and ransom-taking, and we can see that the military is making good progress in this important task.”

He said that the apex bank has retrieved N1.9 trillion out of the N3.2 trillion of currency that is in circulation and in people’s homes, with N900 trillion still to be collected from those who are hoarding the notes.